“Simplifying the Real Estate transaction.”

Helpful Links:

Relocation Guide

Renting vs Buying

Buyers & Sellers Guide

Schedule a Free Consultation

Relocation Guide

Renting vs Buying

Buyers & Sellers Guide

Schedule a Free Consultation

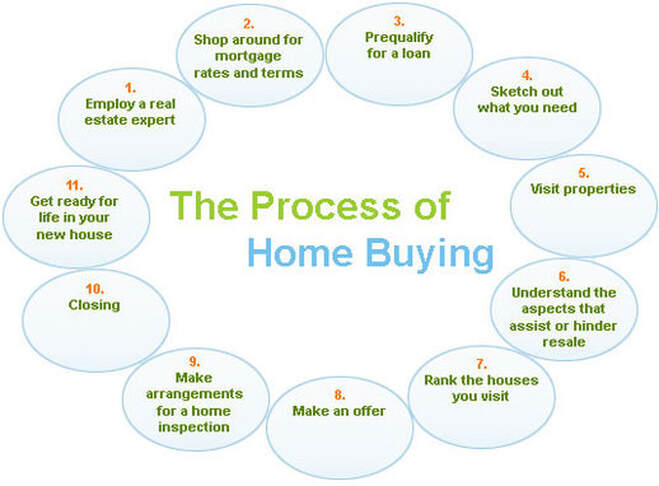

Where to Start

You will find that being informed about the home buying process is empowering. Lucky for you, you came to the right place! Purchasing a home begins with knowing how much home you can afford. Get your finances in order. Give yourself time to clean up a credit report that contains mistakes & dispute errors. Try to reduce your monthly debts by paying down obligations. Check out lenders and compare rates and loan programs. I suggest starting with your banking institution as they may be able to offer members incentives and/or lower rates. Be sure to get a second, even third opinion, by shopping mortgages brokers. Be sure you fully understand the loan program. Just because the payment fits your monthly budget, doesn’t mean the program is the best choice for you. I have several trusted lenders I work with often that are always happy to help and answer questions. However, no one can force you to use a specific lender. As a Buyer, the choice is completely up to you! Once you’ve chosen a lender, obtain a pre-approval letter. You will need to provide this to me prior to touring potential homes & to provide to Sellers when making offers.

The Home Search

The Internet is a great tool in aiding the home search. However, many websites such as Zillow or Realtor.com are not often updated with current information. Many times you see “available” homes when in fact they are already “under contract”, sold or not even listed! When I send properties directly to your email inbox for consideration, you can rest assured that the properties are in fact available, as I send them to you directly from the MLS (Multiple Listing Service). I will speak with you in order to grasp a good sense of your personal home search preferences and send properties that match what you are looking for. You will receive your own personal property portal where you can view your property matches with pictures, prices, taxes, address, directions, maps with bird’s eye views; you see the same information I see in the MLS. Save & track your favorite properties & be the first to know by receiving email updates when there is a price change, the property is sold or new property matches.

Placing an Offer

Once you have narrowed down the homes that interest you most, you’ve toured the properties and picked the one you love most, I’ll help you place an offer. When placing an offer you will need to provide a copy of the pre-approval letter and copy of an earnest money deposit (EMD) check. The amount of the EMD will vary. After negotiations and once the Seller accepts your offer, the EMD check will be deposited with the Escrow Company. Nevada law gives the Buyer the right to choose the escrow/title company.

Closing the Transaction

Once the offer is accepted by the Seller & Escrow is opened, a home inspection should be preformed during the “Due Diligence” period & the Seller will provide all property disclosures. The lender will order a property appraisal & collect any additional financial documentation from you. Documents which will need to be provided to the lender can include: paystubs, tax information, bank statements, employment verifications, credit reports & other documents the lender may require to determine your identity &/or credit worthiness. Once the lender has all documentation to approve funding the loan, loan docs will be provided to escrow/title for your signature. Closing and recording of the proper title paperwork generally will happen 1-3 days after signing loan docs and 30-45 days after the initial offer is accepted. Once the transaction is closed you will pick up the keys to your new home!